The helium supply problem ...

There is currently a major helium shortage affecting a host of industries — and it's not clear how it is going to be resolved.

There is currently a major helium shortage affecting a host of industries — and it's not clear how it is going to be resolved.

Global helium demand has more than doubled over the last twenty years due to the developments in manufacturing, medical imaging and scientific research techniques. The price has surged 500 per cent in the past 15 years, and by over 135% in 2018 alone and demand continues to expand. As new reserves are found and brought on production around the world, the current shortage may ease, but with demand continuing to grow helium supply is likely to remain unstable.

The UK may have its own world-class helium supply, but it is currently completely unexploited at the same time as major UK science projects can only access 70% of the helium they need.

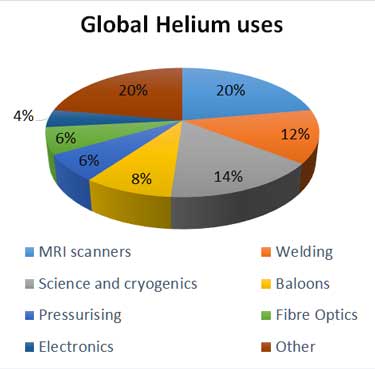

Not only does this affect huge sectors of industry, medicine and science, it will also affect consumers directly as the cost of electronics, such as smart-phones, will rise unless the problem is resolved. Helium is a critical component of medical, aerospace and semiconductor technology, of "Big-Science" and manufacturing industries, for leak detection, welding and deep-sea diving.

Just two countries produce around 85 percent of the world's helium — USA and Qatar. Such limited supply can seriously destabilise markets and badly effect customers. Recently, a coalition of Arab countries blockaded Qatar and temporarily reduced the entire world's helium supply by over 30 percent.

Just two countries produce around 85 percent of the world's helium — USA and Qatar. Such limited supply can seriously destabilise markets and badly effect customers. Recently, a coalition of Arab countries blockaded Qatar and temporarily reduced the entire world's helium supply by over 30 percent.

For most of its supply history the US government has smoothed the market with in its strategic reserve facility, which at its peak held 30 billion cubic feet of helium - enough to meet about 15 years of global demand at that time. However, the US strategic reserve managed by the US Bureau of Land Management (BLM) is winding down and, by law, it will completely close to international sales by October 2021.

Helium has recently been added to the critical minerals list in both the USA and the European Union (EU). The UK government has so far not taken any action, even though the main industrial gas suppliers have issued letters to key users indicating they will be limiting supplies in 2019 and beyond.

Future supply

Reserves and production

Potential global resources of helium were estimated in 2011 to be approximately 1,480 billion cubic feet (bcf). Current annual global use is estimated at 6.2 bcf, so there shouldn't be a shortage, however, very little of the estimated resource can be extracted annually as it is contained in giant methane gas fields and production is constrained by methane production and liquefaction rates. Most known helium reserves lie in the USA, Qatar, Algeria, and Russia.

Qatar and Algeria both produce helium as a by-product of large Liquified Natural Gas (LNG) facilities and as such the quantity of helium, only a few tenths of a percent by volume, can only be increased if LNG production is raised. LNG sales have been rising globally, but strong competition to meet demand comes from other LNG schemes in which no helium is recovered. New facilities; even if commercially viable, take many years to build and commission.

Russia has been producing only small amounts of helium every year. The concentration of the major Russia's helium reserves are located in Eastern Siberia and the Russian Far East, where development is just beginning. A large LNG scheme with helium recovery is planned in Siberia, but estimates for its commissioning are in the range 2021 to 2025, so whilst a potentially valuable new source of helium exists it is not imminent and there are political and supply security issues to be considered. The large Chinese market close to Russian may well absorb much of the new supply.

In Tanzania, whilst the potential helium volumes are huge, no subsurface reservoir has so far been tested to contain trapped helium. Unstable local politics and the remoteness of the region may complicate the process and delay production, even if substantial reserves are eventually proven. In 2016 the prospective recoverable resource was estimated as possibly being up to about 100 bcf based on the discovery of seeps of helium near Lake Rukwa. It is important to realise that no drilling has yet occurred and no helium reserves have been established.

UK Supply and Demand

The UK uses around 0.25 bcf of helium per year, around 4% of the worldwide consumption. This is all imported at a cost to the balance of trade of around £100 million pa at 2019 prices. A world class helium supply is potentially there just waiting under our feet. Unfortunately, the British government appears to prefer to import helium and is taking no action to support indigenous exploration, which could lead to UK production in the next few years.